April Wrap-Up!

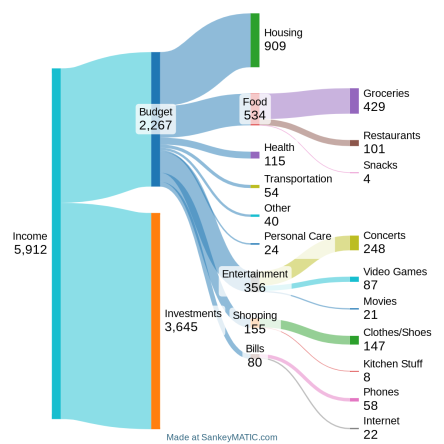

This is another great example of how wildly different our financial patterns are month by month.

Our net worth has been holding roughly steady, finishing April at $823,524, compared to $827,134 at the end of March. We had a solid 62% savings rate for the month, and are at 52% year to date. We expect it to continue climbing, as our large expenses (trip to Morocco + Cel’s annual tax bill) are now done.

Notable things this month:

- That’s a lot of restaurant spending! Fun fact: All three transactions were Vietnamese food. There was no real reason for it; we just really wanted lots of Vietnamese food.

- Holy Batman is that ever a lot of entertainment spending! Our entertainment spending is mostly based on what happens to be available, and sometimes all the cool stuff is compressed into one month. This was three concerts, three video games, one movie, and our monthly CineClub.

- I bought shoes for the first time in a while. I put unreal mileage on my shoes, but still after a couple of years they don’t have any soles left.

- The $40 “Other” was our annual Lunch Money subscription, which we’re liking so far. Having trialled all the options available to Canadians, none of the Mint alternatives are quite there, but this one is pretty close.

- If you’ve been following our Sankeys, you’ll notice our income was considerably lower this month – that’s because we operate on net income, and being self-employed, Cel has a tax bill every April. This is partially offset here by my own tax refund, but it’s still a noticeable difference.

Thats really interesting. thanks for sharing. That sankeyMatic diagram service seems cool. I need to check it out.

the annual lunch thing. Can you tell more about it? Its new to me. Is it one paid restaurant visit per year? Where did you go.

The shoe thing is difficult for me. When my shoes get worn out, I get problems with my knees, or get heel spur issues. So i have to replace my shoes yearly.

Lunch Money is a web-based budgeting program – no food involved 🙂

incredible!

Can you give me some advice on what apps strategies, and tactics you use to invest?

Do you automate your finances and have some money go into ETF’s, GIC’s, or the stock market?

Thank you!

Hi Vimmy, we have an ETF index portfolio through a robo-advisor. It’s all automated.

I love Vietnamese food !!! Totally underrated! Usually very healthy as well.

What are your thoughts about this article: https://www.businessinsider.com/die-with-zero-saving-less-for-retirement-2024-04

This author thinks most people are saving too much for retirement, given that a lot of it goes unused.

Thank you

I think it’s pretty case by case, and depends heavily on your lifestyle before and after retirement. A lot of people have a lot of hidden spending tied up in their jobs that adds up a lot (vehicle/gas/clothing/beauty stuff/restaurants/etc), and then is duddenly gone after retirement.

Your last year’s spend was $33460.

So theoretically, $33460 x 1.03 (inflation factor) x 25 (4% rule) = ~ $862,000 which is something that you should be able to get to this year (the market gods permitting ofcourse). I understand you might not retire right away, but I think that landmark of reaching the “FIRE” number should call for a celebration. A random cookie bake off maybe 🙂

So proud of you both! I find myself coming back to this blog monthly to see your progress and cheer you on!